Fixed Acquirer Network Fee (FANF)

Visa Imposes New "Fixed Acquirer Network Fee" (FANF) to ALL Merchants via Every Processor and Bank Worldwide

What is this fee?

The Fixed Acquirer Network Fee (FANF) is a fee from Visa that went into effect April 1st, 2012. This is a monthly fee for all merchants accepting Visa branded products through the Visa Network. This fee is based on a number of factors including: how you accept these Visa payments, the business's MCC code, the merchant's Tax ID, the number of business locations or the gross volume of Visa transactions during the reported month. For many retail or "card present" merchants, this fee will be based on the number of locations accepting Visa payments. If any amount of a merchant's transactions are taken while the card is not present, an additional fee will be assessed. Please see the charts below for more information. Important: FANF is calculated per merchant taxpayer and includes all merchant accounts owned by that taxpayer. A taxpayer is defined as a legal business entity with its own federal taxpayer identification number (TIN).

Visa FANF: A Closer Look

Simply put, Visa's FANF affects every merchant to some extent. Acceptance methods, such as card not present (CNP), volume, number of locations, and merchant category codes (MCC) are all considered when determining a merchant's FANF. Details of these MCC and acceptance methods are provided below:

Merchant Category Code (MCC): MCCs are used to classify a business by specific market segments. In other words, it reflects the primary category in which a merchant does business. The MCC's have only a slight impact on a merchant's FANF.

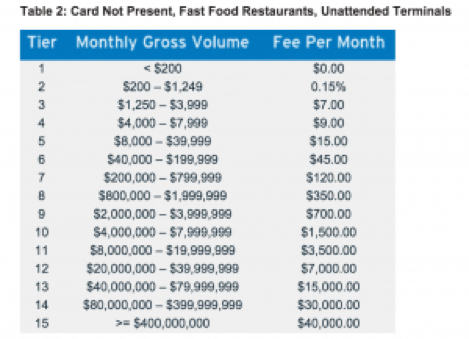

Acceptance Method: The acceptance method is a key factor in determining how much the FANF will be for a merchant. This depends on whether the merchant is a card-present or card-not-present business. Card-present businesses are charged depending on the number of locations, whereas card-not-present (online transactions and fast food restaurants) businesses are charged based on their volume of Visa processing. The latter will see the largest impact.

How will this affect my business?

According to Keefe, Bruyette & Woods, a New York based securities firm, the fees should work as follows:

- • For card-present merchants, the monthly FANF will start at $2 for businesses with one to three locations and $65 for businesses with more than 4,000 locations. High-volume merchants may see an even higher fee depending on volume and number of locations.

- • For card-not-present merchants, the monthly fee will be based on volume and will carry a charge from $2 for sales volume of $50 or less up to $40,000 for merchants with more than $400 million in gross monthly Visa Card sales. The fee table for card-not-present merchants will reportedly have at least 16 tiers.

Card Present

Card Present (high volume)

Card Not Present

Visa modified the FANF in 2015 so that aggregation of tax payer IDs and volume could no longer occur. This means that each tax payer must be billed and reported individually. Visa also reduced pricing for merchants with very low monthly volumes. This may change the above example slightly, but it still gives you a good idea of how this fee is calculated.